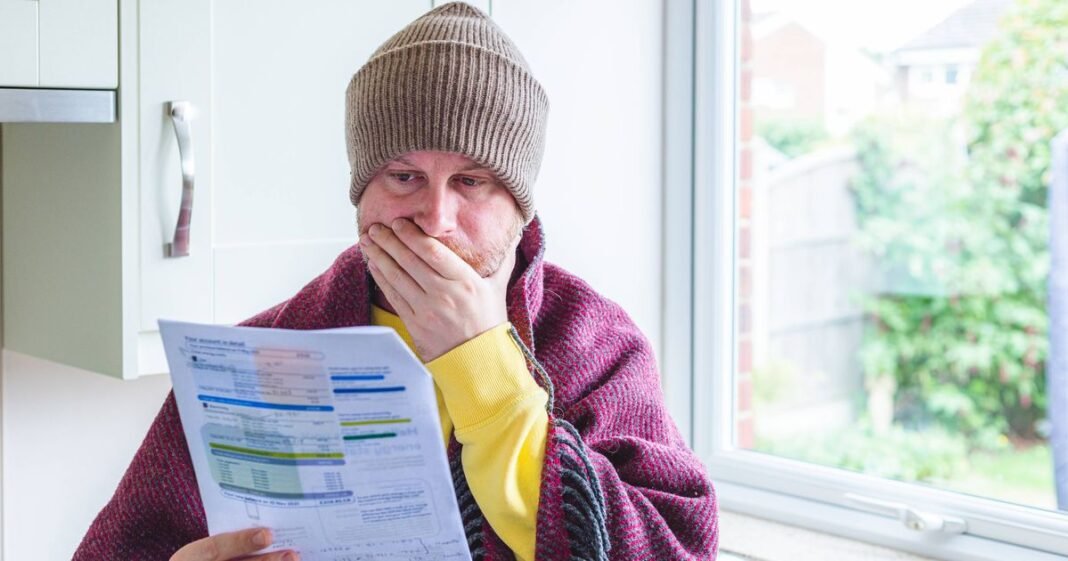

As the new year approaches, many households are bracing for an upcoming rise in energy bills. On January 1, Ofgem’s price cap is set to increase by 0.2%, potentially costing the average customer around £1,758 annually. Despite this small uptick, Ofgem regularly reviews the cap every three months, adding an element of uncertainty for consumers.

In response to these fluctuations, proactive households are increasingly turning to fixed energy deals as a solution. Approximately 21 million households have already made the switch, locking in their unit rates for a specified period. While fixed deals do not guarantee stagnant overall bills, they offer stability in pricing and can result in savings based on individual usage.

For those still on standard variable tariffs, making the switch could lead to significant savings, with average potential savings of around £230 per year. Switching to a new supplier can be a quick process, and customers may not even need to change providers to access better deals. Existing smart meter users can seamlessly switch suppliers, with numerous fixed deals available that are cheaper than Ofgem’s current price cap.

Various energy providers offer competitive fixed deals, such as Ecotricity, Outfox Energy, E.ON Next, So Energy, EDF Energy, Sainsbury’s Energy, and British Gas. These deals come with different contract lengths, annual costs, and exit fees, providing consumers with a range of options to choose from based on their preferences and needs.

Energy Secretary Ed Miliband has urged suppliers to pass on the promised £150 average savings for customers on fixed rates, potentially leading to even lower bills starting next April. By switching now, customers can benefit from reduced prices during the colder months when energy consumption typically peaks.

According to Suzanne Edwards, an energy expert at Uswitch.com, falling wholesale prices have made fixed energy deals more attractive, offering potential savings for households. Conducting a quick energy comparison can help consumers identify cheaper rates and lock in better deals before the impending price cap increase in January.