Renowned expert in personal finance, Martin Lewis, has advised individuals to be cautious when relying on information provided by their local councils regarding council tax and associated discounts. An investigation conducted by MoneySavingExpert.com (MSE) revealed that a significant number of councils in England and Wales are disseminating inaccurate information. The investigation discovered that at least 69 councils have misleading details on their websites regarding the live-in Carer Council Tax discount, resulting in fewer eligible individuals than there actually are.

Out of over 200 councils assessed by MSE, 69, including seven London boroughs, were found to have incomplete and consequently incorrect criteria. This discrepancy means that a minimum of one out of every five councils is displaying erroneous information. The Carer Council Tax discount can reduce a Council Tax bill by either 25% or 50%, with a 25% discount typically amounting to £500 annually.

An additional 80 councils failed to provide easily accessible information online about the necessary qualifying benefits for obtaining the discount. MSE indicated that this omission is likely deterring a significant number of the up to five million unpaid carers from applying. To be eligible for the discount, individuals must be caring for someone receiving specific disability benefits – benefits that some councils have omitted from their information.

This issue impacts a diverse range of individuals, including parents caring for adult children, adult children caring for parents, and adult siblings caring for each other. The root cause appears to be that many councils have not updated their websites since the Carer rules changed back in 2013.

The live-in Carer Council Tax discount essentially disregards the carer for Council Tax purposes. Therefore, if the carer is the sole resident with the person they are caring for, it is treated as if only one person resides in the household, making them eligible for a 25% single person discount (this discount could be higher if the person being cared for also qualifies for the ‘Severe Mental Impairment’ disregard).

a) Applicants are required to provide a minimum of 35 hours of unpaid care per week to someone in their household who is not a spouse, partner, or child under 18.

b) The individual being cared for must be receiving one of several qualifying benefits. Since the reforms in 2013, additional benefits have been included, which many councils have erroneously excluded.

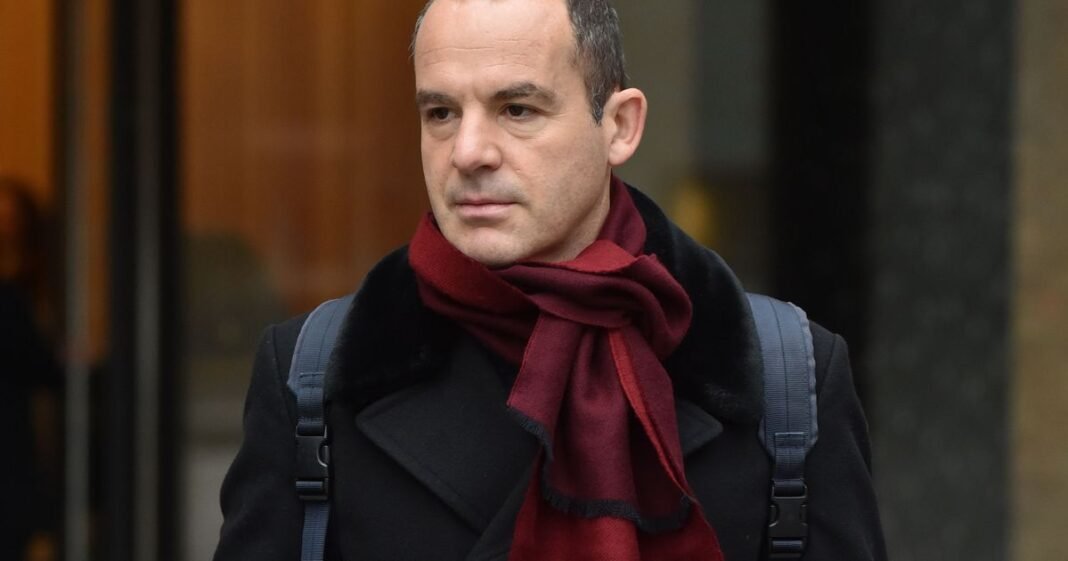

The qualifying benefits necessary for the live-in Carer Council Tax discount differ in Scotland. Martin Lewis, the founder of MoneySavingExpert, emphasized the importance of double-checking eligibility for the Carers’ Council Tax discount, especially for those who previously believed they were ineligible based on council information. Lewis recommended using Carers UK’s help pages for guidance and advised individuals who missed out due to council misinformation to request a backdated discount to the point of initial eligibility, bearing in mind that different councils may have varying rules.

Expressing concern, Lewis stated, “Thirty-five hours a week of unpaid caring is no small feat. This army of up to five million carers provides a silent and often un-thanked backbone that takes a burden off the NHS and care system – reducing the cost to the state.”

He added, “While it’s often done out of love, that doesn’t mean it isn’t hard. And while this discount isn’t means-tested, many individuals providing at least 35 hours of unpaid care per week are likely under significant financial pressure. Therefore, the revelation that they are potentially missing out on hundreds of pounds in discounts due to misinformation from their own councils is distressing.”

Moreover, he pointed out the lack of clarity on the Gov.uk pages about Council Tax, which do not list the qualifying benefits for the discount, making it challenging for taxpayers in England to determine their eligibility.

Efforts are being made to address the misinformation issue. Lewis mentioned plans to contact all the councils involved to urge them to promptly update their websites and ensure compliance with internal policies. He also intends to notify the Ministry of Housing, Communities and Local Government about the information oversight, advocating for a collaborative plan to ensure that Council Tax information is transparent, accurate, and easily accessible.

Helen Walker, chief executive at Carers UK, highlighted the immense value that unpaid carers contribute to the UK economy, estimated at £184 billion annually. However, she emphasized that this support comes with a significant personal and financial toll. Walker noted the financial challenges faced by carers due to the impact of caring responsibilities on their ability to work and the additional expenses incurred.

<p